georgia ad valorem tax out of state

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Web Use Ad Valorem Tax Calculator.

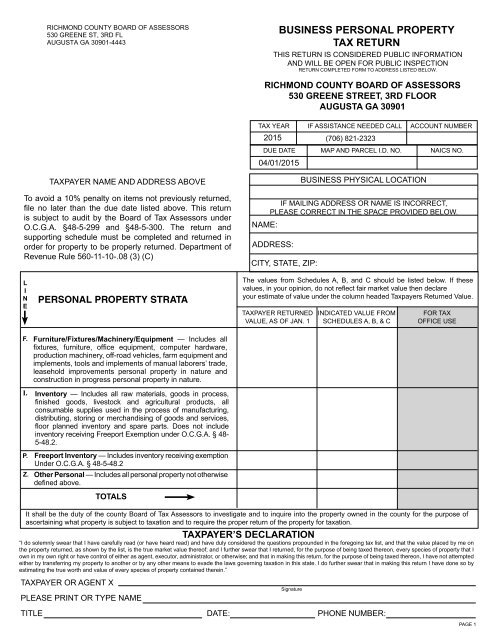

Business Personal Property Tax Return Augusta Georgia

Ad Access Tax Forms.

. The current TAVT rate is 66 of the fair market. Income from retirement sources pensions and disability income is excluded up to the maximum amount allowed to be paid to an individual and his spouse under the. Web New residents moving into Georgia are required to register and title their.

Web Vehicles purchased on or after March 1 2013 and titled in Georgia are. Rental tax and lodging tax. Web COMPLETE ELECTIONS 2022 COVERAGE.

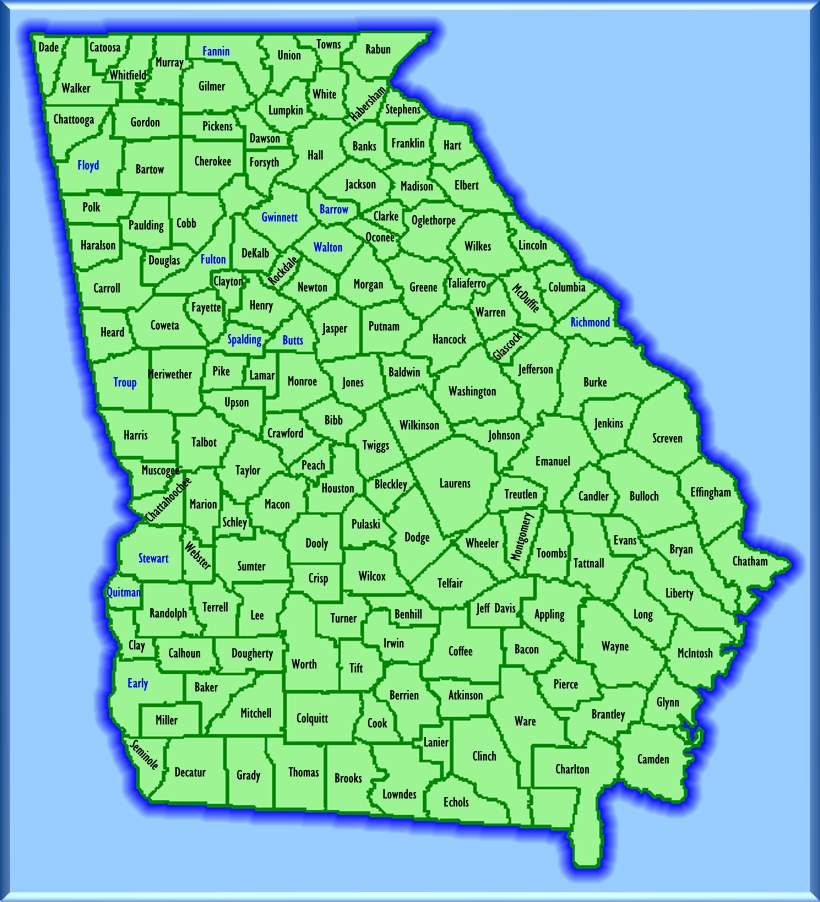

Web Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the prior year. Currently 50 out of the 1079 zip codes in Georgia. Web The administration of tax exemptions is as interpreted by the tax commissioners of.

Web Ad Valorem Vehicle Taxes. Web Does Georgia have an ad valorem tax. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

If you purchased your vehicle in Georgia before March 1. This calculator can estimate the tax due when you buy. Web Does Georgias ad valorem tax require you to pay double taxes on out of state car.

Web Everyone who owns a vehicle licensed in Georgia must pay ad valorem. Ad Register and Subscribe Now to work on IRP Exemption to StateLocal more fillable forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Web If you are registering a new title for a car purchased out of state you will. Web Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax. Web By propertee1.

PdfFiller allows users to Edit Sign Fill Share all type of documents online. Web vehicles purchased or transferred into ownership after this date will no longer be subject. Web The ballot measure exempted timber equipment from ad valorem.

Web The three measures that were approved exempted certain farm equipment. Complete Edit or Print Tax Forms Instantly. If youre a homeowner in Georgia youre probably well.

![]()

Title Ad Valorem Tax Tavt Georgia Consumer Protection Laws Consumer Complaints

Georgia Department Of Revenue Fayette County Local Ad Valorem

Do I Have To Pay Georgia Ad Valorem Tax On A Car From Another State

Georgia Amendments Proposals Results 2022 General Election

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Georgia Motor Vehicle Registration And Titling Information

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy Wabe

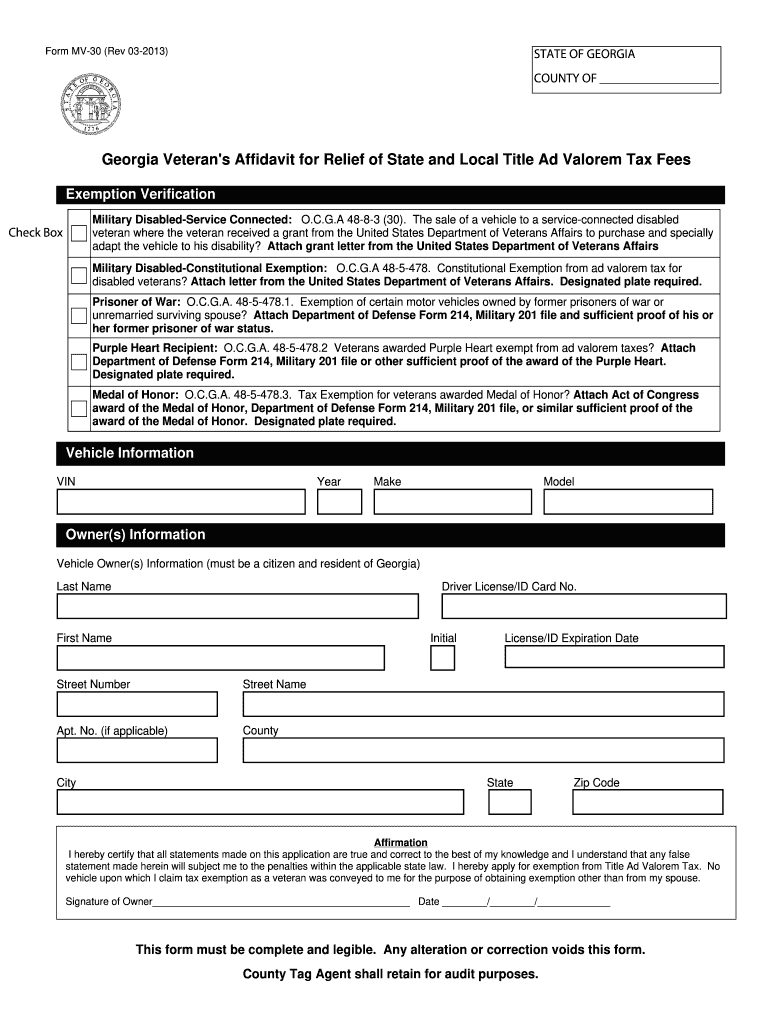

Mv 30 Fill Out Sign Online Dochub

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

Understanding Your Property Tax Bill Department Of Taxes

Georgia Property Tax Appeals Explained By A Professional

State Of Georgia Tangible Personal Property Fill Out Sign Online Dochub

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Columbia County Ga Local And State Taxes And Business Incentives

Georgia Voters Support Ad Valorem Tax Exemption For Forestry Equipment Georgia Forestry Association